- Hardware

Intel closes ‘best year ever,’ according to latest earnings report

The strongest close in the company’s 50-year history.

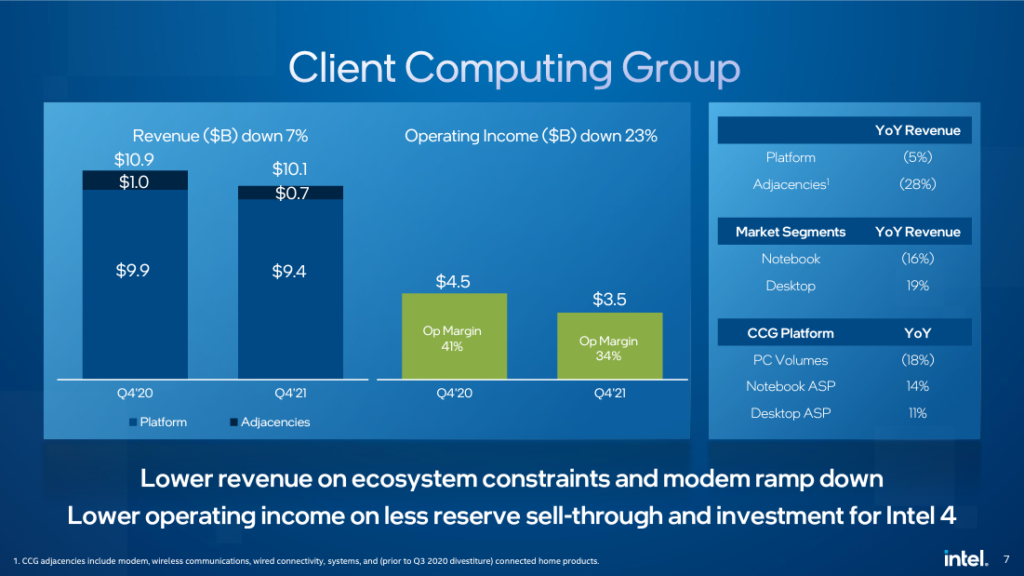

Intel closed out Q4 2021 with $20.5 billion in revenue, the best in the company’s history, pushing its annual take to $79 billion under its new CEO. While the year was an overall success, one interesting point of data is that the seven-percent dip in client computing has some interesting implications with Alder Lake on the horizon, as pointed out by HotHardware.

The company hit its highest quarterly and full-year income with chief executive officer Pat Gelsinger back at the helm. While net income is down across the board, it’s to little consequence. Intel reported $4.6 billion in quarterly net income with annual net income clocking in at $19.9 billion, which saw respective dips of 21 percent and five percent over the previous year.

“Q4 represented a great finish to a great year,” Gelsinger said. “We exceeded top-line quarterly guidance by over $1 billion and delivered the best quarterly and full-year revenue in the company’s history. Our disciplined focus on execution across technology development, manufacturing, and our traditional and emerging businesses is reflected in our results. We remain committed to driving long-term, sustainable growth as we relentlessly execute our IDM 2.0 strategy.”

Gelsinger rejoined the company in February 2021 and is out to leave a mark given the reported numbers in the midst of a worldwide chip shortage and the aggressive rollout of the company’s IDM 2.0 strategy. Intel’s IDM 2.0 strategy has been the talk of the town since the company’s most recent announcement to invest $20 billion in Ohio-based semiconductor fabs. This announcement follows Intel breaking ground in September 2021 on a $20 billion Arizona campus that will include two fabs.

Regarding the seven-percent dip in client computing revenue, this can likely be attributed to Apple’s shift away from Intel CPUs in favor of its own in-house M1 processing solution, according to HotHardware. The kicker to this is the recent release of the Alder Lake mobile CPUs, which are slightly faster than Apple’s M1 chip, according to MacWorld’s latest benchmark results. This small victory could be an early indicator of Intel closing that seven-percent decline in 2022. While the slightly higher performance isn’t likely to pull away many Apple customers, it may attract new ones.

Looking forward, and despite the strong year for Intel, the chip shortage isn’t going anywhere, even with Intel’s aggressive fab network expansions, which are a ways off. While the IDM 2.0 strategy is sure to play a key role in the long run regarding Intel and the U.S.’ status in the semiconductor market, Intel is still forecasting the shortage running through the remainder of 2022 and possibly into 2023.